In international trade, especially in the process of exporting goods from Taiwan to the United States, the ocean freight invoice is a crucial document. It not only involves transportation costs, but also directly relates to customs clearance, cost accounting, and financial processing of both buyers and sellers. Understanding the structure and content of ocean freight invoices helps ensure smooth transactions, reasonable costs, and high compliance.

What Is an Ocean Freight Invoice?

An ocean freight invoice is a detailed list of expenses issued by a carrier or freight forwarder to a shipper, recording all logistics costs incurred during the ocean shipping process from Taiwan to the United States.

This document is not only a voucher for paying freight, but also an important basis for import and export customs declarations, tax declarations, and cost accounting. For Taiwanese exporters, understanding the composition of ocean freight invoices helps to accurately estimate logistics costs and avoid affecting delivery timeliness due to cost disputes.

Key Components of an Ocean Freight Invoice

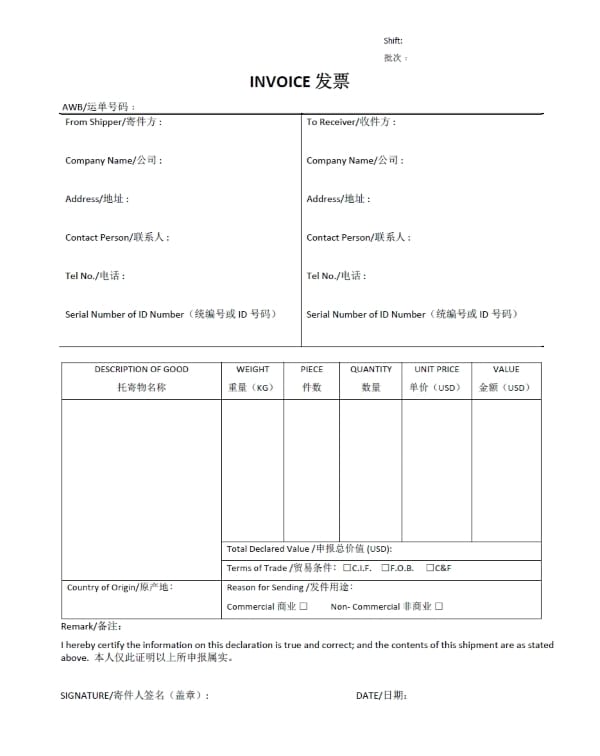

A standard ocean freight invoice usually contains the following key components:

- Party information: Shipper (Taiwan exporter), consignee (US buyer), notify party (if any)

- Transportation details: departure port (such as Kaohsiung Port), destination port (such as Los Angeles Port), mode of transportation (FCL/LCL)

- Cargo description: HS code, product name, packaging type, volume weight

- Cost details: basic freight, surcharge (BAF/CAF, etc.), document fee

- Payment terms: payment deadline, accepted currency (usually USD)

Common Charges Included in the Invoice

When shipping from Taiwan to the USA, expect these charges:

- Ocean Freight Rate (base cost for sea transport)

- Bunker Adjustment Factor (BAF) (fuel surcharge)

- Terminal Handling Charges (THC) (port fees)

- Container Demurrage & Detention (late return fees)

- Customs Clearance Fees (brokerage, duties, taxes)

- Insurance (optional but recommended)

Incoterms and Their Impact on Freight Invoice

International trade terms (Incoterms) will directly affect the content of the freight invoice and who bears the costs. The following are some common terms and their impact on the invoice:

- FOB (Free on Board): The seller is responsible for all costs before the goods are loaded on the ship, and the buyer bears the costs of shipping and the port of destination. The freight invoice will be issued to the buyer.

- CIF (Cost, Insurance and Freight): The seller is responsible for the shipping costs and insurance, and the invoice usually includes freight and insurance.

- DAP/DDP (Delivered at Place / Delivered Duty Paid): The seller bears all costs to the US door point, and the freight invoice will include the destination customs clearance and delivery costs.

How to Verify the Accuracy of an Ocean Freight Invoice

After receiving the invoice, the shipper or consignee should check its accuracy from the following aspects:

Compare the bill of lading information

Confirm that the invoice content is consistent with the actual shipping data.

Check the charges

Compare the quotation to confirm whether there is overcharge or duplicate charges.

Review the billing unit

Ensure that the charges are charged per container, per ticket, per ton, and in accordance with the agreement.

Check the currency and amount

Confirm that the amount and currency are correct.

Verify the scope of service

Whether the expected service (such as door-to-door or door-to-port) is included.

Tips for Reducing Ocean Freight Cost

The transportation cost of exporting from Taiwan to the United States can be effectively reduced by the following ways:

- Choose the appropriate transportation method: If the cargo volume is insufficient, you can choose LCL to save costs.

- Book space in advance: avoid price increases during peak seasons.

- Compare multiple freight forwarding quotations: Find a cost-effective service provider.

- Optimize packaging and cargo stacking: improve container utilization and reduce dimensional weight.

- Use long-term cooperation agreements: lock in favorable prices.

- Choose Incoterms appropriately: allocate cost burden according to bargaining power.

- Monitor fuel surcharges and seasonal rate fluctuations.

The shipping invoice from Taiwan to the United States is not only a charging voucher for the transportation process, but also one of the core documents in international trade. Through this article, you can understand its composition, verification methods and cost control techniques to improve import and export efficiency and cost management capabilities.